Who is Steve Schonfeld?

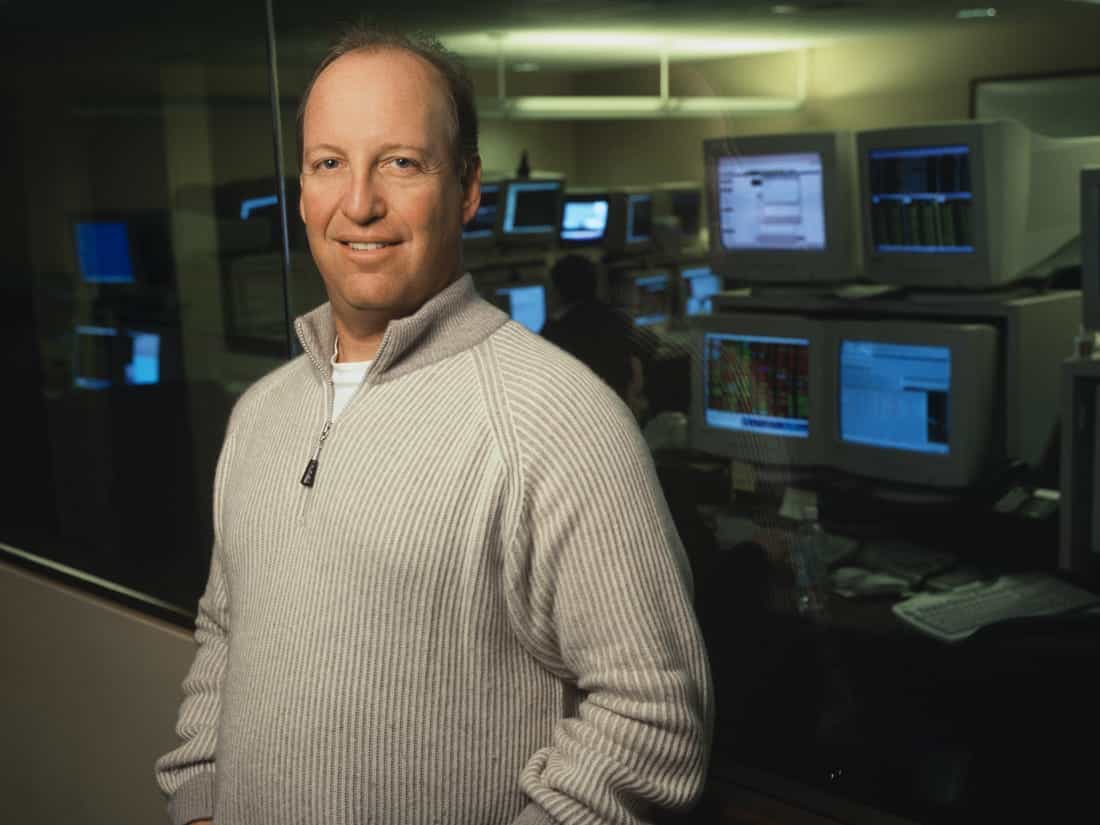

Steve Schonfeld is an American entrepreneur and investor who is best known for co-founding the company Schonfeld Strategic Advisors, a quantitative hedge fund.

Schonfeld is a graduate of the University of Pennsylvania and the Wharton School of Business. He began his career as a financial analyst at Goldman Sachs. In 1996, he co-founded Schonfeld Strategic Advisors with Ryan Tolkin.

Schonfeld Strategic Advisors is a quantitative hedge fund that uses mathematical models to make investment decisions. The firm has over $10 billion in assets under management and is one of the most successful hedge funds in the world.

Schonfeld is also a philanthropist and has donated millions of dollars to various charitable organizations.

Schonfeld is a highly successful entrepreneur and investor. He is also a generous philanthropist who has made a significant impact on the world.

Here is a table with some of Steve Schonfeld's personal details:

| Name | Steve Schonfeld |

| Born | 1966 |

| Occupation | Entrepreneur, investor, philanthropist |

| Net worth | $3.2 billion |

Steve Schonfeld

Steve Schonfeld is an American entrepreneur, hedge fund manager, and philanthropist. He is the co-founder and CEO of Schonfeld Strategic Advisors, a quantitative hedge fund that uses mathematical models to make investment decisions.

- Entrepreneur

- Hedge fund manager

- Philanthropist

- Quantitative investor

- Wharton graduate

- Billionaire

Schonfeld is a highly successful entrepreneur and investor. He has built Schonfeld Strategic Advisors into one of the most successful hedge funds in the world. He is also a generous philanthropist who has donated millions of dollars to various charitable organizations.

Schonfeld's success is a testament to his hard work, intelligence, and dedication. He is a role model for aspiring entrepreneurs and investors. His story is an inspiration to us all.

1. Entrepreneur

Entrepreneurs are individuals who create and manage their own businesses, taking on the risks and rewards associated with doing so. Steve Schonfeld is a successful entrepreneur who has founded and grown several businesses, including Schonfeld Strategic Advisors, a quantitative hedge fund that uses mathematical models to make investment decisions.

- Vision and Leadership

Entrepreneurs have a vision for their businesses and are able to articulate that vision to others. They are also able to motivate and lead teams of people to achieve their goals. - Risk-taking

Entrepreneurs are willing to take risks in order to achieve their goals. They are not afraid to fail, and they are always looking for new opportunities. - Innovation

Entrepreneurs are constantly innovating and coming up with new ideas. They are not afraid to think outside the box and challenge the status quo. - Adaptability

Entrepreneurs are able to adapt to change quickly and easily. They are always looking for new ways to improve their businesses and stay ahead of the competition.

These are just a few of the qualities that make Steve Schonfeld a successful entrepreneur. He is a visionary leader who is willing to take risks and innovate. He is also a highly adaptable individual who is always looking for new ways to improve his businesses.

2. Hedge fund manager

Steve Schonfeld is a hedge fund manager. This means that he manages a pool of money for investors and makes investment decisions on their behalf. Hedge fund managers typically charge a fee for their services, and they may also receive a share of the profits if the fund performs well.

- Investment strategies

Hedge fund managers use a variety of investment strategies to generate returns for their investors. Some common strategies include:- Long-short equity

- Convertible Arbitrage

- Fixed Income Arbitrage

- Statistical Arbitrage

- Risk management

Hedge fund managers also play a role in risk management. They must carefully consider the risks of each investment and take steps to mitigate those risks. This may involve using hedging techniques, such as options or futures contracts. - Performance measurement

Hedge fund managers are typically evaluated based on their performance. This may include measures such as the fund's rate of return, its Sharpe ratio, and its volatility. - Fees and compensation

Hedge fund managers typically charge a fee for their services. This fee may be a percentage of the fund's assets under management or a performance-based fee. Hedge fund managers may also receive a share of the profits if the fund performs well.

Steve Schonfeld is a successful hedge fund manager. He has generated strong returns for his investors over the long term. He is also a pioneer in the use of quantitative investment strategies.

3. Philanthropist

Steve Schonfeld is a philanthropist who has donated millions of dollars to various charitable organizations. He is particularly interested in supporting education and medical research. Schonfeld is also a strong advocate for social justice and has donated to organizations that work to promote equality and opportunity for all.

Schonfeld's philanthropy is motivated by his belief that everyone deserves a chance to succeed. He believes that education is the key to unlocking human potential and that everyone should have access to quality healthcare. Schonfeld is also passionate about social justice and believes that everyone should have the opportunity to live a life of dignity and respect.

Schonfeld's philanthropy has made a significant impact on the lives of many people. He has helped to fund scholarships for students, provided funding for medical research, and supported organizations that work to promote social justice. Schonfeld is a true philanthropist who is making a difference in the world.

4. Quantitative investor

Steve Schonfeld is a quantitative investor. This means that he uses mathematical models and computer programs to make investment decisions. Quantitative investors believe that by using data and analysis, they can identify undervalued stocks and make profitable trades.

- Data analysis

Quantitative investors use a variety of data to make investment decisions. This data may include financial data, such as stock prices, earnings, and dividends, as well as economic data, such as GDP growth and inflation rates. - Mathematical models

Quantitative investors use mathematical models to analyze data and identify undervalued stocks. These models may be simple or complex, and they may be based on a variety of statistical techniques. - Computer programs

Quantitative investors use computer programs to implement their investment strategies. These programs may be used to collect data, analyze data, and execute trades. - Risk management

Quantitative investors also use mathematical models and computer programs to manage risk. These models may be used to identify potential risks and to develop strategies to mitigate those risks.

Steve Schonfeld is a successful quantitative investor. He has generated strong returns for his investors over the long term. He is also a pioneer in the use of quantitative investment strategies.

5. Wharton graduate

Steve Schonfeld is a Wharton graduate. This means that he earned a degree from the Wharton School of the University of Pennsylvania, one of the world's leading business schools. Wharton is known for its rigorous curriculum and its focus on quantitative analysis. Schonfeld's Wharton education has given him the skills and knowledge he needs to be a successful entrepreneur and investor.

Many of the skills that Schonfeld learned at Wharton are essential for success in the business world. For example, Wharton students learn how to analyze data, solve problems, and make sound decisions. They also learn how to communicate effectively and work in teams. These skills are essential for any entrepreneur or investor who wants to be successful.

Schonfeld's Wharton education has also helped him to develop a network of relationships with other successful businesspeople. These relationships have been invaluable to Schonfeld throughout his career. He has been able to learn from other successful entrepreneurs and investors, and he has been able to access capital and resources that would not have been available to him otherwise.

Overall, Schonfeld's Wharton education has been a major factor in his success as an entrepreneur and investor. The skills and knowledge he learned at Wharton have given him the foundation he needs to build a successful business.6. Billionaire

Steve Schonfeld is a billionaire. This means that he has a net worth of at least $1 billion. Schonfeld's wealth comes from his success as an entrepreneur and investor. He is the co-founder and CEO of Schonfeld Strategic Advisors, a quantitative hedge fund that uses mathematical models to make investment decisions.

- Investment acumen

Schonfeld is a highly successful investor. He has generated strong returns for his investors over the long term. Schonfeld's investment acumen is based on his deep understanding of the markets and his ability to identify undervalued stocks. - Entrepreneurial spirit

Schonfeld is a successful entrepreneur. He has founded and grown several businesses, including Schonfeld Strategic Advisors. Schonfeld's entrepreneurial spirit is based on his vision, leadership, and ability to take risks. - Philanthropy

Schonfeld is a generous philanthropist. He has donated millions of dollars to various charitable organizations. Schonfeld's philanthropy is based on his belief that everyone deserves a chance to succeed. - Networking

Schonfeld has a strong network of relationships with other successful businesspeople. These relationships have been invaluable to Schonfeld throughout his career. He has been able to learn from other successful entrepreneurs and investors, and he has been able to access capital and resources that would not have been available to him otherwise.

Schonfeld's billionaire status is a testament to his hard work, intelligence, and dedication. He is a role model for aspiring entrepreneurs and investors. His story is an inspiration to us all.

FAQs about Steve Schonfeld

This section provides answers to frequently asked questions about Steve Schonfeld, an American entrepreneur, hedge fund manager, and philanthropist.

Question 1: Who is Steve Schonfeld?

Answer: Steve Schonfeld is an American entrepreneur, hedge fund manager, and philanthropist. He is the co-founder and CEO of Schonfeld Strategic Advisors, a quantitative hedge fund that uses mathematical models to make investment decisions.

Question 2: What is Schonfeld Strategic Advisors?

Answer: Schonfeld Strategic Advisors is a quantitative hedge fund that uses mathematical models to make investment decisions. The firm has over $10 billion in assets under management and is one of the most successful hedge funds in the world.

Question 3: What is Steve Schonfeld's net worth?

Answer: Steve Schonfeld's net worth is estimated to be $3.2 billion, according to Forbes.

Question 4: Is Steve Schonfeld a philanthropist?

Answer: Yes, Steve Schonfeld is a generous philanthropist. He has donated millions of dollars to various charitable organizations, including those that support education and medical research.

Question 5: What are Steve Schonfeld's investment strategies?

Answer: Steve Schonfeld is a quantitative investor. He uses mathematical models and computer programs to make investment decisions. Schonfeld's investment strategies have generated strong returns for his investors over the long term.

Summary: Steve Schonfeld is a successful entrepreneur, hedge fund manager, and philanthropist. He is the co-founder and CEO of Schonfeld Strategic Advisors, one of the most successful hedge funds in the world. Schonfeld is also a generous philanthropist who has donated millions of dollars to various charitable organizations.

Transition to the next article section: Steve Schonfeld is a role model for aspiring entrepreneurs and investors. His story is an inspiration to us all.

Conclusion

Steve Schonfeld is a highly successful entrepreneur, hedge fund manager, and philanthropist. He is the co-founder and CEO of Schonfeld Strategic Advisors, one of the most successful hedge funds in the world. Schonfeld is also a generous philanthropist who has donated millions of dollars to various charitable organizations.

Schonfeld's success is a testament to his hard work, intelligence, and dedication. He is a role model for aspiring entrepreneurs and investors. His story is an inspiration to us all.

You Might Also Like

Unleash The Sweet Torment: Adam's Sweet Agony Manga ExploredLeaked OnlyFans Videos Of Jellybeans Brains

See Leaked Jelly Bean Brains Onlyfans [Here]

[Your Prefix] Ben 10 Sultry Summer Fun [Your Suffix]

Jake Andrich's Twitter: Get The Latest Updates And Insights

Article Recommendations